Tax season has no chill. It doesn't care if you're busy, behind, or blissfully ignoring your unopened mail. One minute, you're sipping coffee; the next, you're elbow-deep in receipts, wondering if Venmo counts as income (spoiler: it might). Missing a deadline means penalties, panic, and possibly rage-eating pretzels at 2 a.m. But don't stress—this guide has your back.

April 15, 2025—The Big One You Can't Ignore

Credit: iStockphoto

Circle it, bold it, or even shout it into your group chat—April 15 is the date you absolutely cannot afford to ignore. That Tuesday marks the deadline to file your 2024 federal tax return or lock in a six-month extension. This is the deadline that separates smooth sailing from a money mess. Handle it now; breathe easy later.

June 16, 2025—The Overseas Taxpayers' Extended Deadline

Credit: Getty Images

If you're living overseas—or stationed abroad with the military—you've got a little breathing room. The IRS gives expats and military personnel an automatic two-month extension to file federal taxes by shifting the deadline to June 16, 2025 (since the 15th falls on a Sunday).

Watch the Clock

Credit: pexels

Procrastinators, beware: the IRS draws a hard line at 11:59 p.m. on April 15—local time. That's your deadline to e-file your federal return for the 2025 season. Miss it by a minute—even 12:01 a.m.—and it's considered late, penalties included. Plus, IRS systems can go down for maintenance (especially early Sunday mornings), so don't gamble with a last-second upload.

Extended Deadlines for the Disaster Struck

Credit: pixabay

When life throws hurricanes, fires, or worse your way, the IRS doesn't expect you to juggle tax forms in the rubble. People within a federally declared disaster zone will likely get extra time to file—like May 1, 2025, for Hurricane Helene-affected areas or October 15, 2025, for L.A. wildfire survivors.

IRS Free File Opens January 10, 2025

Credit: pexels

If your adjusted gross income for 2024 came in under $84,000, the IRS has a sweet setup just for you. Starting January 10, 2025, you can hop on the Free File program and knock out your federal return without spending a cent. The software walks you through it, and some providers even toss in a state filing for free.

Final Call for 2024's Estimated Tax Payments

Credit: pexels

The IRS sees the espresso-fueled freelance grind, too—and they want their share. Freelancers and gig workers had until January 15, 2025, to make their final estimated tax payment for the 2024 tax year. If you missed it, expect interest and possible penalties. Special rule for farmers and fishers: they could have paid the entire balance by January 15 or filed their return by March 3 to avoid late-payment fees.

January 27, 2025—The IRS Opens Its Doors for Tax Season

Credit: iStockphoto

The IRS officially opened tax season on January 27, 2025. Filing early helped taxpayers avoid refund delays, identity theft, and last-minute filing stress. If you haven't filed yet, it's not too late—but don’t wait much longer.

January 31, 2025—W-2s Due to Employees

Credit: pexels

Business owners, this one's for you—January 31, 2025, was your red-circle day. That's when W-2s needed to land in your employees' hands, covering every paycheck and tax withheld during 2024. The same goes for filing Copy A and the W-3 with the SSA by that same date.

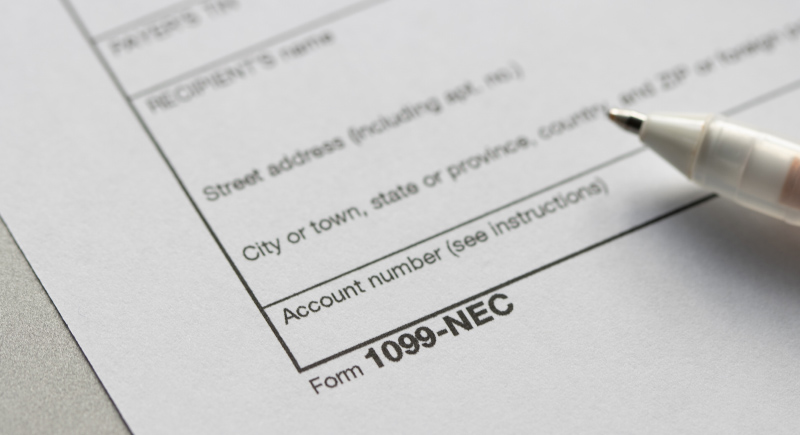

Navigating the 2025 Form 1099 Distribution Deadlines

Credit: iStockphoto

If you paid a contractor $600 or more in 2024, Form 1099-NEC needed to be filed with the IRS and sent to the recipient by January 31, 2025. That date also applied to most 1099-MISC, 1099-INT, and 1099-DIV forms—except for those with specific boxes checked, which allowed until February 17.

Final Dates for 1099s

Credit: pexels

Businesses filing 1099s on paper had until February 28, 2025. Those using e-file had until March 31—with the exception of 1099-NEC, which still held firm on January 31. Filing electronically remains the best way to avoid late penalties.

February 18, 2025—Deadline to Renew Your Withholding Exemption

Credit: pexels

If you claimed exempt status from withholding in 2024, you needed to submit a new Form W-4 to your employer by February 18, 2025, to keep it active. This applies only if you had no tax liability last year and expect none this year.

IRS Penalties and Interest

Credit: iStockphoto

Missing the federal tax deadline means inviting a stack of penalties. The IRS charges 5% of what you owe for every month your return is late, up to 25%. Wait over 60 days, and the fine jumps to at least $510. Add a 0.5% monthly penalty for not paying and daily interest at a 7% annual rate, and things get messy fast.

File for an Extension

Credit: iStockphoto

Let's say tax season snuck up on you—life gets unpredictable. The good news is you may have a built-in escape hatch. File Form 4868 by April 15, and the IRS will hand you a six-month breather by pushing your deadline to October 15, 2025. But don't mistake a filing extension for a payment pass. You still need to pay any taxes owed by April 15.

Avoiding the Chaos In Tax Filing Season

Credit: pexels

Getting your paperwork in order early—W-2s, 1099s, receipts, and those sneaky deductible expenses—turns the whole process from chaos to calm. Early prep helps you spot money-saving deductions you might miss in a last-minute scramble. Plus, with everything ready to go, you'll catch mistakes before they snowball.

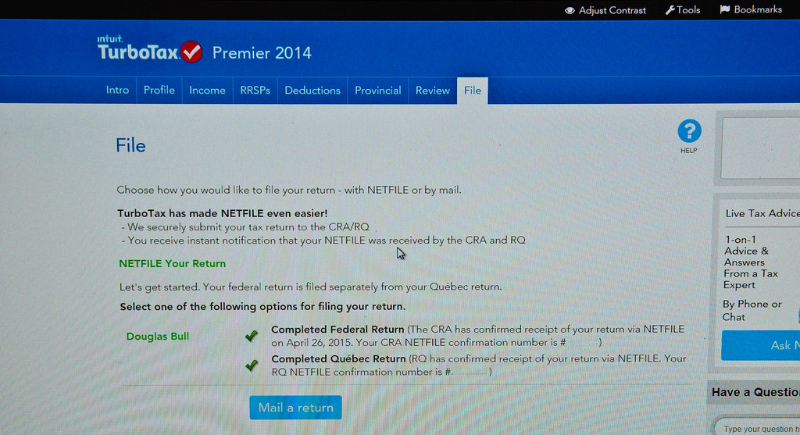

E-Filing Is the Smart Choice

Credit: pexels

Filing taxes doesn't have to be a paperwork headache. E-filing your 2024 return gets your info to the IRS in under 24 hours—paper filing can't compete. Faster processing means faster refunds, especially with direct deposit. It's smart, safe, and comes with built-in checks to catch mistakes before they cost you.

Unlock Hidden Savings

Credit: flickr

Modern day's smart tax software turns the whole ordeal into something surprisingly manageable—even kind of satisfying. Programs like TurboTax Deluxe walk you through hundreds of potential deductions and credits with clear, custom questions. Instead of guessing, you get real-time explanations and automatic imports of W-2s and 1099s.