Your credit card doesn’t disappear just because you’re not around to swipe anymore. In fact, time in jail can quietly wreck your finances if you’re not prepared. Interest keeps piling up, and creditors don’t stop calling. And the legal consequences don’t wait for your release, either.

Here's how incarceration messes with your debt—and what you need to know to protect your financial future.

That Debt Isn’t Going Anywhere

Credit: Getty Images

Credit card debt doesn’t magically disappear when you’re booked. Lenders still charge interest every day you don’t pay. That balance keeps growing even when you’re locked up in a cell. In fact, the longer you’re in, the worse it gets.

Collections Don’t Care Where You Are

Credit: Getty Images

Once you miss a few payments, your lender can hand your debt to a collection agency. And that’s when things might get even worse. These agencies don’t press pause either and go after your family. They’ll file lawsuits, and that unpaid bill becomes a legal problem waiting for you at the gate.

Yes, Creditors Can Sue You—Even in Jail

Credit: pexels

Being locked up doesn’t shield you from civil court. Creditors can still sue you, and if they win, they might slap a lien on your property or garnish any money you earn. Some have even targeted prison wages, no matter how small. It’s legal, and it’s happening.

Your Credit Score Takes a Beating

Credit: Getty Images

Credit bureaus won’t factor in your incarceration if they see missed payments and ballooning balances. A tanked score can affect everything—finding housing, getting a phone, even landing a job. Rebuilding takes time, and the longer you wait to deal with it, the harder it gets.

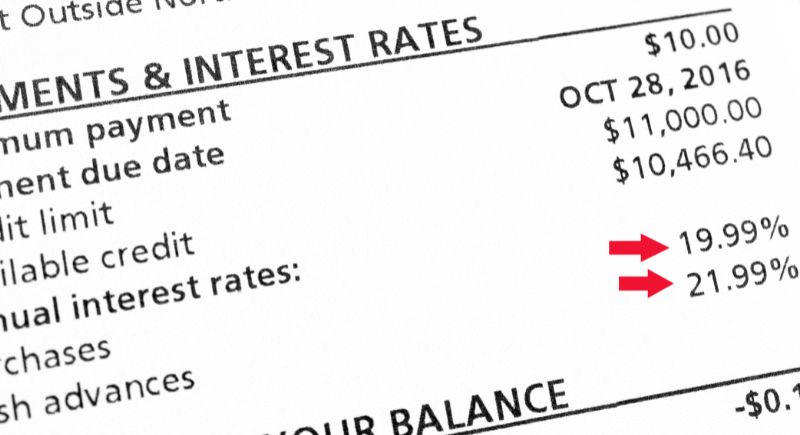

The Fees Stack Up—Fast

Credit: Getty Images

Late fees feel small at first. Ten bucks here, thirty bucks there. But over time, they snowball. Add high interest rates, and your balance can double. One missed payment becomes five. If no one’s watching your accounts while you’re inside, you’re coming out to financial quicksand.

Prison Jobs Pay Pennies—Literally

Credit: Getty Images

Let’s talk income. Most prison jobs pay under $1 an hour. That’s barely enough for soap, let alone a $200 minimum credit card payment. Without a plan or outside help, your finances spiral while you're stuck earning next to nothing for years.

Silence Hurts—Reach Out to Lenders Early

Credit: corelens

Many credit card companies have hardship programs. They won’t advertise them, but they exist. You—or someone on your behalf—needs to call before payments stop. Some will freeze interest or set up a pause. But you have to speak up. Silence guarantees penalties.

Nonprofit Help Exists—Before You Go In

Credit: pexels

Nonprofit credit counseling agencies offer real help. They can create a debt management plan, reduce interest rates, and combine payments into one. However, timing matters; starting before incarceration gives them time to set things up. After you’re inside, it’s much harder to coordinate anything.

You Might Owe the Court Too

Credit: pexels

Court fines, restitution, and administrative fees stack up fast—and they don’t vanish. These legal financial obligations are separate from your credit cards but just as serious. Fall behind, and they can extend your sentence, block parole, or result in new charges.

Student Loans? Don’t Ignore Them

Credit: Getty Images

Federal student loans offer deferment or income-based plans—even during incarceration. But they won’t enroll you automatically. If you do nothing, you’ll default. That adds late fees and wrecks your credit even more. Reach out to your loan servicer or have someone do it for you.

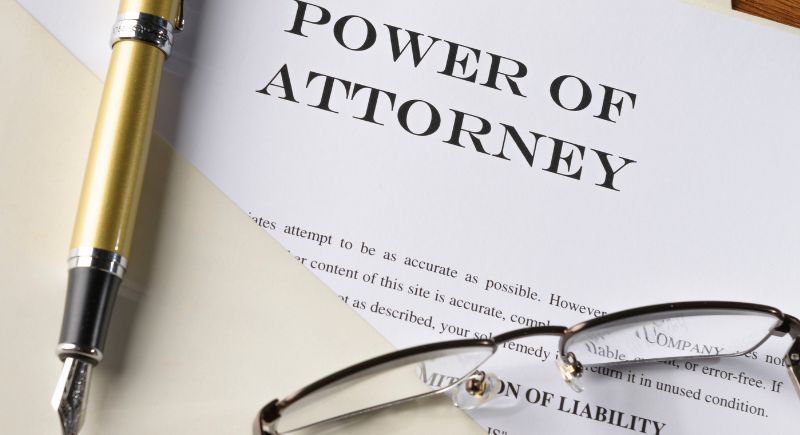

Power of Attorney Can Be a Lifesaver

Credit: DAPA Images

A financial power of attorney lets someone you trust handle your money while you’re in prison. That person can pay your bills, contact creditors, and stop things from falling apart. Without it, no one can legally act for you. It's a simple step that protects everything.

Some Prisons Charge You Rent (No, Really)

Credit: pexels

In pay-to-stay facilities, inmates get charged daily fees just for being locked up. Rates vary by state, but some people leave prison owing thousands in jail rent. If you can't pay, you may get sued later. It’s controversial, but it’s legal in more places than you'd think.

Your Family Might Inherit Your Debt Problems

Credit: Getty Images

If someone co-signed your credit card or loan, they're on the hook when you stop paying. Lenders can go after them without warning. Even if they didn’t co-sign, your debt can shift responsibility onto your family—emotionally or financially.

Rebuilding Starts With Knowing What’s Broken

Credit: Getty Images

Once you're out, start by pulling your credit report. Look at every account. Make a budget. See what you owe. Then get help—many reentry programs offer financial counseling, job placement, and credit repair advice. It’s not instant, but small steps add up.

Lawyers Aren’t Just for Criminal Defense

Credit: pixelshot

A financial or consumer protection attorney can walk you through your debt options—before or after prison. They can help negotiate with creditors, fight lawsuits, or explore bankruptcy. A quick consult might save you thousands.