It might seem as if big business rules the world, but that doesn’t mean they aren't above suspicion. In fact, companies have to comply with various rules, regulations and laws to avoid criminal and civil negligence.

Most people can’t afford to pay for a lawsuit to sue a company or institution. That’s where a class action lawsuit comes in. It allows groups of people with the same or similar grievances whose alleged damages are too small to warrant an individual lawsuit to join forces and have their cases represented.

Class actions have enabled individuals to hold some of the world's most powerful organizations accountable for their actions, from the environmental effects of oil spills to the defrauding of shareholders. And in some cases, the settlement amounts are staggering.

These are the biggest class action settlements of all time.

20. SCANA Lawsuit

Construction on a new nuclear reactor at Plant Vogtle power plant in Waynesboro, Georgia, in 2014. John Bazemore / AP Photo

Company: SCANA Corporation

Year: 2018

Settlement amount: $192.5 million

Bottom Line: SCANA Lawsuit

U.S. Attorney Peter McCoy, front, briefs reporters outside of the Matthew J. Perry, Jr. Courthouse after the plea hearing of former SCANA Corp. executive Stephen Byrne in Columbia, South Carolina, in July 2020. Michelle Liu / AP Photo

In 2018, SCANA Corp. agreed to a $2.5 billion settlement with the customers it charged high electric rates (an additional $30 on average, included in their monthly bills) for a failed nuclear plant construction project.

After the construction company building the plant went bankrupt in 2017, customers brought a class action lawsuit.

In July 2020, a federal judge approved a final settlement of $192.5 million between the former SCANA shareholders and the company’s new owner Dominion Energy.

19. Exxon Valdez Oil Spill Litigation

An oil-soaked bird is examined on an island in Prince William Sound, Alaska, in April 1989. Jack Smith / AP Photo

Company: Exxon Valdez

Year: 2001

Settlement amount: $500 million

Bottom Line: Exxon Valdez Oil Spill Litigation

A worker makes his way across the polluted shore of Block Island, Alaska, in 1989, as efforts got underway to test techniques to clean up the oil spill of the tanker Exxon Valdez in Prince William Sound. John Gaps III / AP Photo

Before the 2010 BP oil spill, the most notable – and devastating – oil spill was the 1989 Exxon Valdez spill.

It occurred when a tanker accidentally ran ashore and spilled millions of gallons of oil into Prince William Sound, Alaska.

In 2001, around 32,000 plaintiffs in a class action lawsuit were awarded $5 billion in punitive damages, although the amount was later reduced to $500 million.

18. Auto Parts Antitrust Class Action

New cars. Getty Images

Companies: 160 auto parts manufacturers, including Sanden and Tenneco

Year: 2018

Settlement amount: $1.05 billion

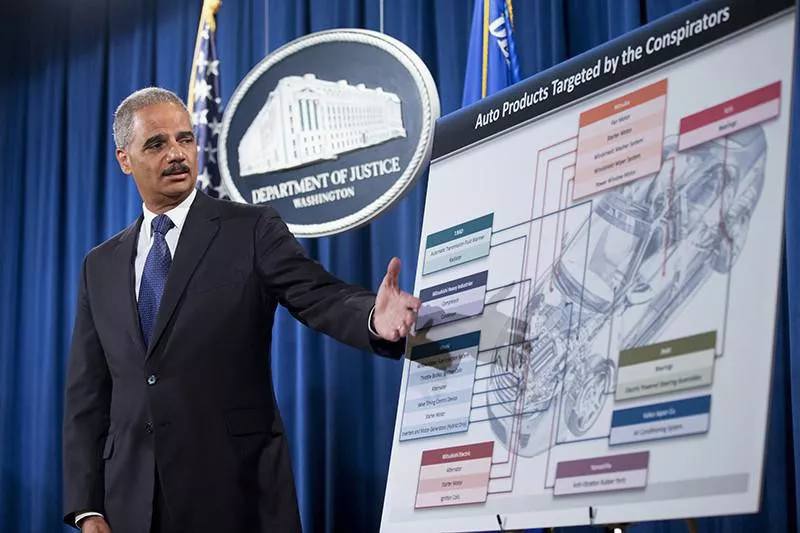

Auto Parts Antitrust Class Action

U.S. Attorney General Eric Holder points to an illustration of auto parts during a news conference at the Justice Department in Washington, D.C., in 2013. Manuel Balce Ceneta / AP Photo

A huge number of auto parts manufacturers agreed to pay $1.05 billion to auto dealers, consumers and mechanics following their deliberate participation in a price-fixing scheme.

The massive global conspiracy kept vehicle and replacement auto part prices unnaturally high and ended up being one of the biggest U.S. antitrust lawsuits ever.

The initial agreement of more than $640 million was reached in 2016, but this was revised following the inclusion of more plaintiffs in the class action.

17. Syngenta Corn Litigation

The agrochemical corporation Syngenta is based in Basel, Switzerland. Georgios Kefalas / AP Photo

Company: Syngenta

Year: 2018

Settlement amount: $1.5 billion

Bottom Line: Syngenta Corn Litigation

An Illinois corn and soybean farmer loads his field planter with Syngenta insecticide. Seth Perlman / AP Photo

Various corn growers and exporters filed a class action lawsuit against Syngenta, an agricultural seed developer, in 2013.

The suit was based on Syngenta’s sale of a corn seed before it got import approval in several countries, including China, who subsequently rejected shipments that might contain the seed.

A settlement amount of $1.5 billion was approved in 2018, and claims administrators began sending payments to farmers in March 2020.

16. USDA Racial Discrimination

Demonstrators take part in a National Black Farmers Association rally outside the U. S. Department of Agriculture in Washington, D.C., in 2002. Dennis Cook / AP Photo

Defendant: U.S. Department of Agriculture

Year: 2010

Settlement amount: $2.3 billion

Bottom Line: USDA racial discrimination

Black farmers and their relatives in Memphis, Tennessee, file claim applications related to a settlement of their lawsuit against the Agriculture Department in 2012. Adrian Sainz / AP Photo

Around 20,000 black farmers were awarded cash payments and debt relief in a 2010 settlement of racial discrimination claims in the administration of federal farm loan programs.

The farmers said they were unjustly being denied farm loans or subjected to longer waits for loan approval, accusing the USDA of racism and failure to respond to their complaints.

The total settlement, including an earlier partial settlement in the case Pigford v. Glickman, reached $2.3 billion.

15. Bank of America’s Acquisition of Merrill Lynch

John Thain, Merrill Lynch chairman and CEO, left, and Ken Lewis, Bank of America chairman and CEO, at a 2008 news conference in New York. Craig Ruttle / AP Photo

Company: Bank of America Corp.

Year: 2013

Settlement amount: $2.4 billion

Bottom Line: Bank of America’s acquisition of Merrill Lynch

Bank of America-Merrill Lynch specialists work on the floor of the New York Stock Exchange in 2011. Richard Drew / AP Photo

In 2013, a federal judge in New York approved a $2.4 billion settlement relating to claims that Bank of America Corp hid vital information from shareholders when it acquired the investment bank Merrill Lynch & Co. at the peak of the 2008 financial crisis.

As part of the agreement, around four to five million investors were due to receive shares in the company.

14. Actos Diabetes Drugs Case

Takeda is a Japanese multinational pharmaceutical and biopharmaceutical company. Getty Images

Company: Takeda Pharmaceutical

Year: 2015

Settlement amount: $2.4 billion

Bottom Line: Actos Diabetes Drugs Case

Takeda is one of the largest pharmaceutical companies in the world by revenue. Getty Images

The reputation of Actos, at one time the best-selling Type 2 diabetes drug in the world, took a hit in 2015 when the manufacturer, Japanese drug company Takeda Pharmaceutical, agreed to pay out $2.4 billion over safety claims.

More than 10,000 people claimed they have experienced adverse (and potentially life-threatening) health effects from using Actos.

In 2012, Takeda was accused of wrongdoing by one of its safety consultants, who alleged that the company knew about Actos’ link to several types of cancer but failed to act.

13. Nortel Accounting Fraud

Nortel Networks Corp. offices in Santa Clara, California, in 2009. Paul Sakuma / AP Photo

Company: Nortel Networks

Year: 2006

Settlement amount: $2.45 billion

Bottom Line: Nortel Accounting Fraud

Nortel president and CEO Mike S. Zafirovski, at a news conference in Mumbai, India, in 2007. Gautam Singh / AP Photo

Under a 2006 settlement amounting to $2.45 billion, telecommunications company Nortel Networks agreed to pay $575 million in cash and issue shares equal to around 14.5 percent of its current outstanding equity.

The case was a complex one. It actually consisted of two separate class action securities fraud suits, brought by different shareholder groups, who claimed that Nortel Networks recorded phony sales between 2001 and 2003.

12. AOL Time Warner Accounting Fraud

Pedestrians pass by AOL Time Warner headquarters in New York's Rockefeller Center. Suzanne Plunkett / AP Photo

Company: AOL Time Warner

Year: 2006

Settlement amount: $2.5 billion

Bottom Line: AOL Time Warner accounting fraud

Time Warner chairman Gerald Levin, right, and AOL chairman Steve Case testify in Washington in 2000 at the Federal Communication Commission on the proposed merger of their companies. Susan Walsh / AP Photo

A class action lawsuit brought against AOL Time Warner and the auditing firm Ernst & Young resulted in a $2.5 billion settlement, approved by a federal judge in New York in 2006.

The shareholders complained that AOL inflated advertising revenue between 1998 and 2002, both before and after its merger with Time Warner.

Despite the agreement, Time Warner continued to deny the investors’ allegations of misconduct.

11. Tyco Accounting Scandal

Tyco International chairman and chief executive Dennis Kozlowski in 2002. Shawn Baldwin / AP Photo

Company: Tyco International Ltd.

Year: 2007

Settlement amount: $3.2 billion

Bottom Line: Tyco Accounting Scandal

Former Tyco CEO Dennis Kozlowski, center, leaves court with his wife, Karen, right, in New York in 2005. Gregory Bull / AP Photo

In 2006, the U.S. Securities and Exchange Commission filed a civil action against Tyco International Ltd, claiming that Tyco executives defrauded shareholders via various improper accounting practices, including a scheme involving worthless transactions that overstated its reported financial results by at least $1 billion.

The following year, a federal judge in New Hampshire approved settlements worth $3.2 billion. Additionally, Tyco’s former CEO Dennis Kozlowski served six and a half years in prison and paid $167 million in restitution and fines.

Former CFO Mark Swartz also served prison time and paid $72 million in restitution and fines.

10. Cendant Accounting Fraud

Cendant broke up and spun off or sold its constituent consumer businesses in 2005 and 2006. Getty Images

Company: Cendant Corporation

Year: 2000

Settlement amount: $3.2 billion

Bottom Line: Cendant Accounting Fraud

Former Cendant Corp. cchairman Walter Forbes arrives at the U.S. District Court in Bridgeport, Connecticut, for a sentencing hearing in 2007. Michelle McLoughlin / AP Photo

In 1998, a class action lawsuit against travel and real estate company Cendant Corp. became the largest case of accounting fraud of all time.

It’s estimated that deliberate accounting irregularities over a period of several years lost investors $19 billion. In 2000, a federal judge in New Jersey approved a $3.2 billion settlement for shareholders.

Cendant chairman Walter Forbes and vice chairman Kirk Shelton were later imprisoned on conspiracy charges and ordered to pay over $3 billion each in restitution.

9. Native Americans vs. U.S. Government

Elouise Cobell in front of an oil well on the Blackfeet Indian Reservation near Browning, Montana, in 1999. Ray Ozman / AP Photo

Defendants: The Department of Interior and the Department of the Treasury

Year: 2011

Settlement amount: $3.4 billion

Bottom Line: Native Americans vs. U.S. government

Elouise Cobell, left, shakes hands with Secretary of the Interior Ken Salazar in 2009 in Washington, D.C., before the start of a Senate Indian Affairs Committee hearing on the multibillion dollar Cobell v Salazar lawsuit regarding decades of mismanagement of Indian lands. Evan Vucci / AP Photo

Elouise Cobel remembers her parents wondering why they weren't getting paid regularly for letting others use their land to farm and drill for oil.

In 1996, Cobell and other Native American representatives brought a class action lawsuit against the Department of Interior and the Department of the Treasury, alleging that the federal government had mismanaged funds in land trust accounts dating back to the 19th century.

In 2011, a federal judge in the District of Columbia gave a $3.4 billion settlement final approval, authorizing $1,000 payments to about 325,000 individuals, beginning in 2012.

8. Diet Pills Payout

A clinic in Nashville, Tennessee. Mark Humphrey / AP Photo

Company: American Home Products Corporation

Year: 2000

Settlement amount: $3.75 billion

Bottom Line: Diet Pills Payout

Attorney Ronald Benjamin, left, with his client Dawn Serina and her son Nicholas after a news conference in New York, in 1997. Serina took the diet drug fen-phen during the first two months of her pregnancy and believed it caused his birth defects. Bebeto Matthews / AP Photo

Before the diet drug combination fen-phen, sold by American Home Products Corporation, was pulled from the market in 1997, thousands of people claimed they were injured from using it.

In 2000, a federal judge in Philadelphia approved a $3.75 billion settlement – at the time, one of the largest in a product liability case.

Under the agreement, people who used one of the diet drugs for 60 days or less were eligible for $30 to $60 prescription refunds, while those with a heart valve injury were eligible for as much as $1.5 million.

7. Silicone Breast Implants Damages

Shells for NovaGold breast implants cool on molds at the company's Minneapolis plant in 1999. Scott Cohen / AP Photo

Companies: Bristol-Myers Squibb, Dow Corning and the Baxter Healthcare Corporation

Year: 1994

Settlement amount: $4.25 billion

Bottom Line: Silicone Breast Implants Damages

Jeannie Carter demonstrates against what she alleges is a coverup on the dangers of breast implants during a protest in front of the Bernalillo County Courthouse in Albuquerque, New Mexico, in 1997. Jake Schoellkopf / AP Photo

Three leading producers of silicone gel breast implants were ordered to pay out $4.25 billion to thousands of women around the world who claimed they were injured by the product, alleging serious neurological and immune disorders.

Each woman was given up to 30 years to collect between $200,000 and $2 million, depending on the severity of the injuries.

6. WorldCom Telecommunications Accounting Scandal

WorldCom was acquired by Verizon Communications in 2006. Rogelio Solis / AP Photo

Company: WorldCom

Year: 2005

Settlement amount: $6.1 billion

Bottom Line: WorldCom Telecommunications Accounting Scandal

Former WorldCom CEO Bernard Ebbers, second from left, and others, appear before a hearing on Capitol Hill in 2002. Rick Bowmer / AP Photo

In 2005, a federal judge in New York concluded a fraud litigation class action lawsuit against the telecommunications company WorldCom, resulting in settlements to shareholders amounting to $6.1 billion.

The company manipulated its financial information to falsely inflate the earnings on its profit and loss statement by nearly $4 billion. Banks involved in the settlement included Bank of America and Citigroup. JP Morgan Chase paid $2 billion of the total.

For their part in the accounting scandal, former WorldCom executives Bernie Ebbers and Scott Sullivan served jail time.

5. Visa/MasterCard Antitrust Lawsuit

Credit cards. Elise Amendola / AP Photo

Companies: Visa and MasterCard

Year: 2019

Settlement amount: $6.2 billion

Bottom Line: Visa/MasterCard antitrust lawsuit

Visa and MasterCard will have to pay. Getty Images

A long-running suit between leading U.S. merchants and Visa and MasterCard was finally settled in 2019 by way of an agreement for at least $5.54 billion and as much as $6.2 billion.

The merchants claimed that Visa and MasterCard had breached antitrust laws by fixing prices to benefit the nation’s top banks.

An appeal of the final approval order was filed in January 2020, so this case may not be over just yet.

4. Enron Energy Securities Fraud

A woman carries a box from the Enron headquarters in Houston in 2001. Pat Sullivan / AP Photo

Company: Enron

Year: 2008

Settlement amount: $7.2 billion

Bottom Line: Enron Energy Securities Fraud

Former Enron CEO Jeff Skilling, left, leaves the federal courthouse on Houston after being sentenced to 292 months in federal prison in 2006. David J. Phillip / AP Photo

In 2008, Enron investors (an estimated 1.5 million individuals and institutions) were awarded a $7.2 billion class action settlement to resolve fraud claims against the energy trading company.

The bulk of the settlement monies were provided by Citigroup, JP Morgan Chase and the Canadian Imperial Bank of Commerce.

Former Enron executives Kenneth Lay and Jeffrey Skilling were convicted of conspiracy and fraud. Lay died of a heart attack less than six weeks after the verdict, while Skilling was released in 2018.

3. Volkswagen Diesel Emissions Scandal

Volkswagen was founded in 1937 by the German Labour Front. Markus Schreiber / AP Photo

Company: Volkswagen

Year: 2016

Settlement amount: $14.7 billion

Bottom Line: Volkswagen Diesel Emissions Scandal

Volkswagen of America CEO Michael Horn, center, before a House Oversight and Investigations subcommittee hearing on Volkswagen's emissions-rigging scandal in 2015. Manuel Balce Ceneta / AP Photo

The Volkswagen emissions scandal, also called Dieselgate or Emissionsgate, started with a notice of violation of the Clean Air Act from the United States Environmental Protection Agency (EPA).

The agency said Volkswagen had deliberately programmed turbocharged direct injection (TDI) Diesel engines to cheat the testing process.

In 2016, a federal judge in San Francisco approved a $14.7 billion settlement to provide funds for vehicle buybacks at market values prior to the scandal, plus additional cash payments for 475,000 diesel car owners.

2. BP Gulf of Mexico Oil Spill

Fire boat response crews spray water on the burning BP Deepwater Horizon offshore oil rig in 2010. U.S. Coast Guard / AP Photo

Company: BP

Year: 2016

Settlement amount: $20 billion

Bottom Line: BP Gulf of Mexico Oil Spill

Oil cleanup workers use absorbent booms to collect oil and tar balls in Orange Beach, Alabama, 2010. Dave Martin / AP Photo

Considered to be the largest marine oil spill in the history of the petroleum industry, the BP oil spill (also known as the Deepwater Horizon oil spill or the Macando blowout) started on April 20, 2010, following an offshore rig explosion in the Gulf of Mexico.

Six years later, a New Orleans federal judge approved an estimated $20 billion settlement resolving civil claims over environmental damage from the 134 million gallons of petroleum that spilled into the gulf.

Judge Barbier ruled that BP had been "grossly negligent" in the explosion, which killed 11 workers.

1. Tobacco Industry Medical Costs for Smoking-Related Illnesses

A person smokes a Marlboro cigarette, a Phillip Morris product. Alan Diaz / AP Photo

Companies: Phillip Morris Inc., RJ Reynolds, Brown & Williamson, Lorillard

Year: 1998

Settlement amount: $206 billion

Bottom Line: Tobacco Industry Medical Costs for Smoking-Related Illnesses

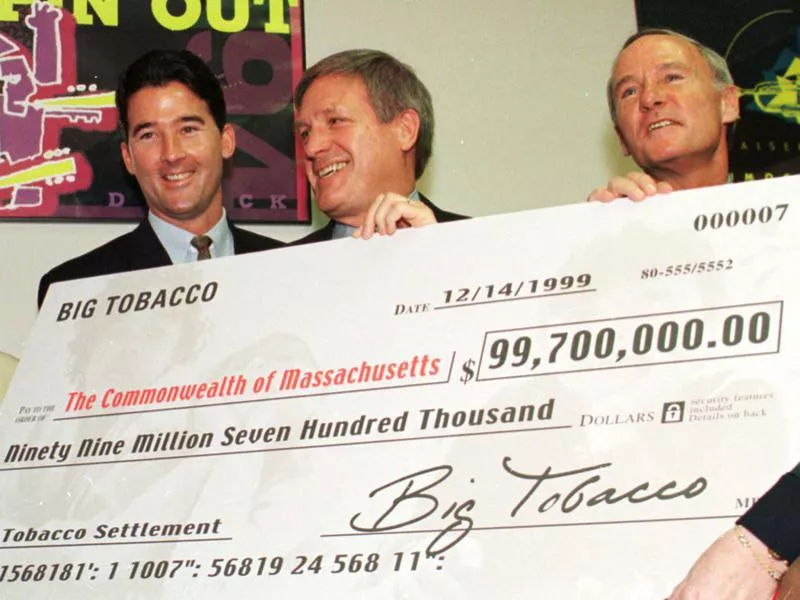

Massachusetts was one of the states that received big money from the national tobacco settlement. Jennifer Taylor / AP Photo

History was made in 1998 when the four largest tobacco companies in the U.S. agreed to a $206 billion settlement covering medical costs for smoking-related illnesses.

The companies entered into the Tobacco Master Settlement Agreement (MSA) with the attorneys general of 46 states to settle Medicaid lawsuits, agreeing to provide annual payments over 25 years.

The companies also agreed to reduce or stop certain commonplace tobacco marketing practices, including using cartoons, outdoor advertising, billboard, product placement in media and free product samples.