Financial fraud is a serious crime that often comes with massive fines and lengthy jail sentences.

But even the prospect of being locked up for a long time doesn’t deter some people from swindling investors for their own personal gain.

These are the biggest con artists of all time.

31. "Count" Victor Lustig

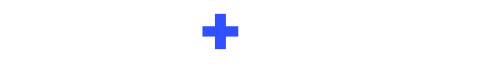

Victor Lustig, center, being questioned by U.S. authorities in 1935. Page from a 1935 Philadelphia newspaper / Wikimedia Commons

Country: France

Company: N/A

Type of business: N/A

Fraud amount: $2 million

Bottom Line: "Count" Victor Lustig

The Eiffel Tower in 1927. Library of Congress

"Count" Victor Lustig, known as "America’s greatest con man," was a highly skilled career criminal who instigated scams across Europe and the United States during the early 20th century.

In the mid-1920s, he forged official papers that stated he had the right to sell Paris’s Eiffel Tower for scrap metal. He managed to find two scrap metal dealers who bribed him the equivalent of $2 million in today’s money to get the (fake) contract.

Lustig then escaped to the U.S. to continue swindling innocent people out of their cash.

30. Billy McFarland

Billy McFarland was the promoter of the failed Fyre Festival in the Bahamas. Mark Lennihan / AP Photo

Country: United States

Company: Fyre Media

Type of business: Media booking service

Fraud amount: $27.4 million

Bottom Line: Billy McFarland

Billy McFarland leaves federal court after his arraignment in New York in 2017. Mary Altaffer / AP Photo

Billy McFarland promised the luxury festival of a lifetime. But the Fyre Festival, due to take place in the Bahamas in April and May 2017, was a disaster: unhygienic accommodations, a shortage of food, water, and other essentials, and a distinct lack of A-list influencers.

In 2018, McFarland pleaded guilty to three counts of wire fraud, one count of bank fraud and a charge of making false statements. He was ordered to pay back more than $26 million to those he defrauded and jailed for six years in federal prison.

29. William Cameron Morrow Smith

View of Broad Street, looking north, in downtown Philadelphia in 1936. AP Photo

Country: United States

Company: N/A

Type of business: N/A

Fraud amount: $30 million

Bottom Line: William Cameron Morrow Smith

Philadelphia in 1939. Paul Vanderbilt / Library of Congress

In 1936, the biggest mail fraud scheme in history saw 28 people get indicted by the federal grand jury. It centered around Jacob Baker, an extremely wealthy Philadelphia resident who died while his estate remained unprobated.

This meant anyone named Baker could make a claim (for a fee). At least that’s what the group of scammers, led by William Cameron Morrow Smith, told the nation.

They took $3 million from 3,000 people — around $30 million in today’s money. The truth was that Jacob Baker never existed.

28. Geraldine Elizabeth Carmichael

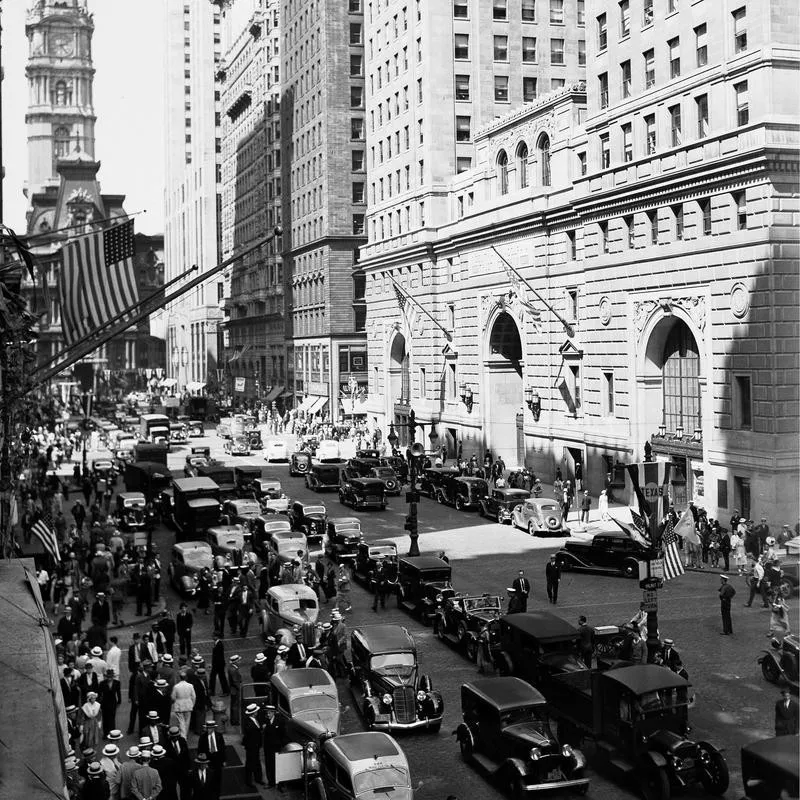

Con artist Geraldine Elizabeth "Liz" Carmichael started the Twentieth Century Motor Car Corporation in 1974. Legion of Weirdos - Christopher Mast / YouTube

Country: United States

Company: Twentieth Century Motor Car Corporation

Type of business: Motoring

Fraud amount: $33 million

Bottom Line: Geraldine Elizabeth Carmichael

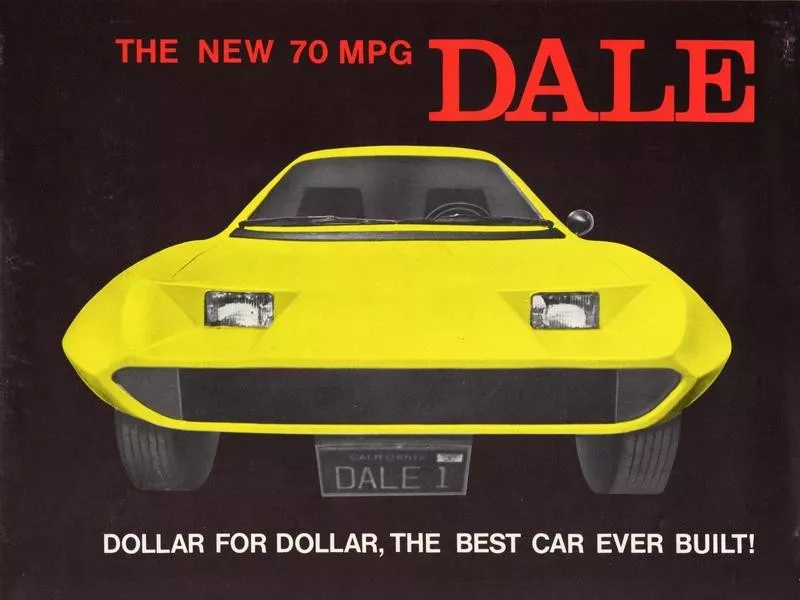

An advertisement for the Dale. Alden Jewell / Wikimedia Commons

The Dale was hailed as the answer to the 1970s fuel crisis: a three-wheeled, 70 miles per gallon car that looked like nothing that had come before.

It was the brainchild of Geraldine Elizabeth Carmichael, the founder of the Twentieth Century Motor Car Corporation. But it was nothing more than a scam. An investigation by "Car and Driver" found that there were no manufacturing plants, research and development facilities, or production plans.

The imaginary Dale had earned Carmichael $30 million in investment and $3 million in advance sales.

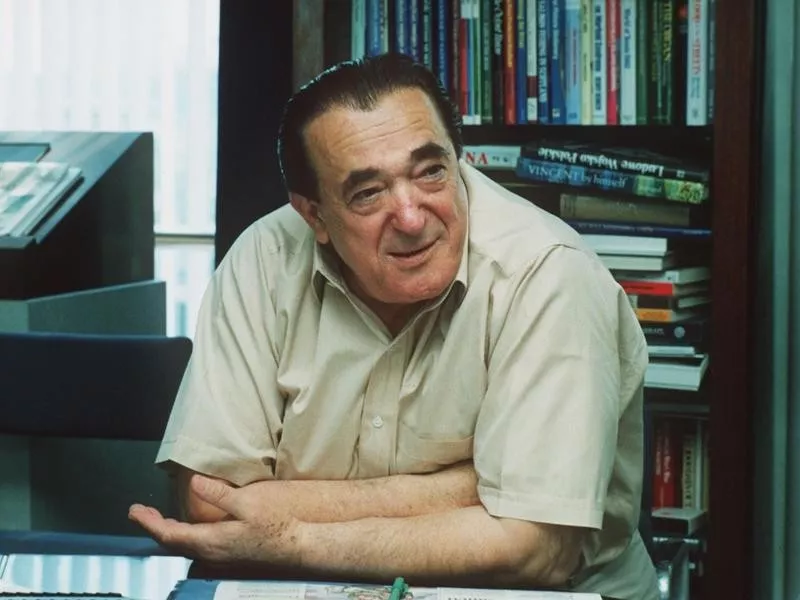

27. Emanuel Pinez

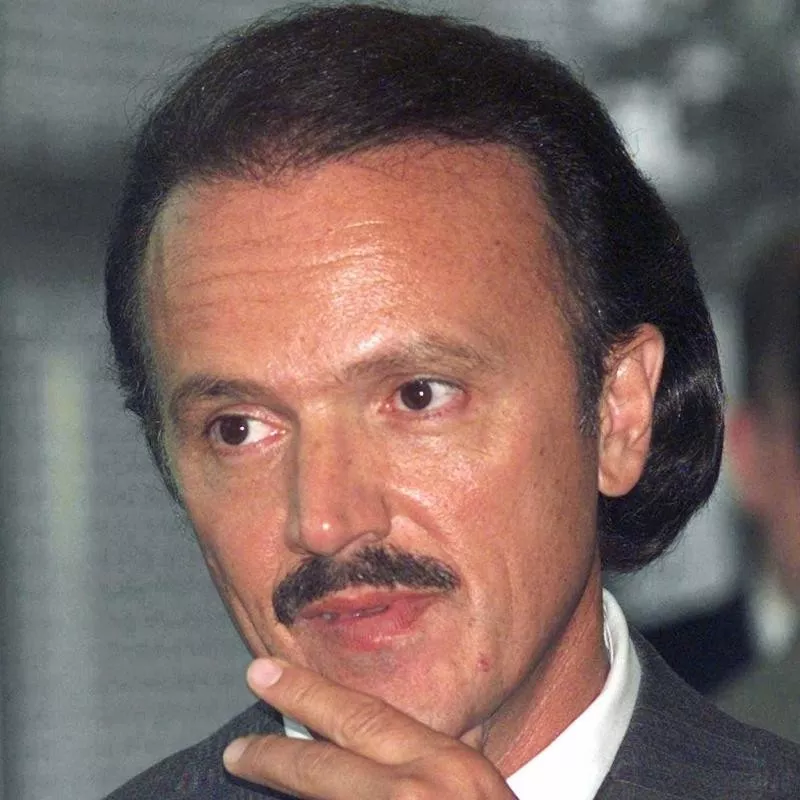

Emanuel Pinez was the former CEO of Centennial Technologies. Granite Media

Country: United States

Company: Centennial Technologies

Type of business: Tech

Fraud amount: $40 million

Bottom Line: Emanuel Pinez

A fruit basket is not a PC memory card. Getty Images

In 1996, the CEO of Centennial Technologies reported revenue of $2 million from PC memory cards. But Emanuel Pinez’s company was actually shipping fruit baskets to customers, creating fake documents to support their fraudulent claims.

As a result of the scam, the company’s stock rose 451 percent to $55.50 per share on the New York Stock Exchange. Then, Pinez sought to profit off the phony stocks.

He was sentenced to five years in jail for securities fraud and ordered to pay $150 million in restitution.

26. Jordan Belfort

Jordan Belfort, the real-life "Wolf of Wall Street," in 2013. Evan Agostini / AP Photo

Country: United States

Company: Stratton Oakmont

Type of business: Investment

Fraud amount: $100 million-plus

Bottom Line: Jordan Belfort

Jordan Belfort became a motivational speaker. Hoo-Me.com / AP Photo

Jordan Belfort ran a hugely successful penny-stock scam, buying large amounts of worthless stock to drive up its price, then selling his shares all at the same time. After pleading guilty to fraud and related crimes in 2003, Belfort spent 22 months (of a four-year sentence) in jail.

He later published a successful memoir "The Wolf of Wall Street," which was adapted into a hit movie by Martin Scorsese, starring Leonardo DiCaprio as the scamming stockbroker.

Belfort also used his experience to become a motivational speaker, spekaing at seminars like "The Power of Persuasion Using the Wolf of Wall Street's Straight Line System."

25. Eddie Antar

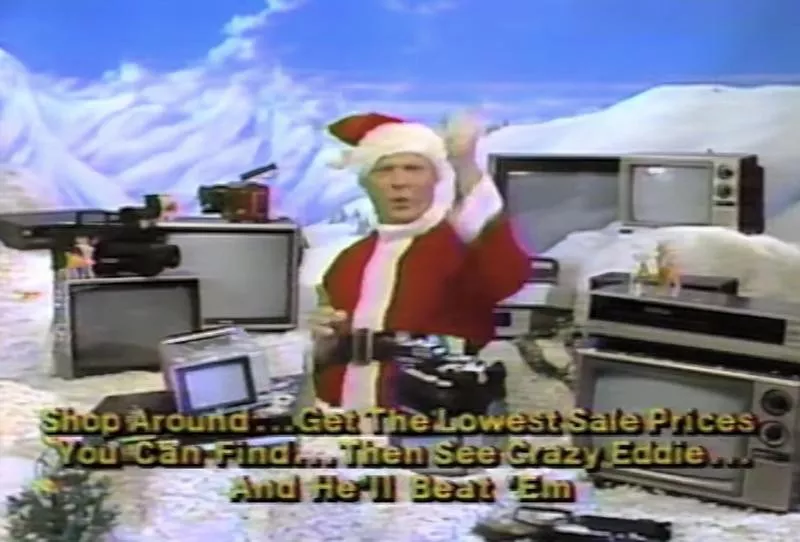

A Crazy Eddie's commercial. Steve Herold / YouTube

Country: United States

Company: Crazy Eddie

Type of business: Retail

Fraud amount: $145 million

Bottom Line: Eddie Antar

"Crazy" Eddie Antar, center, founder of the Crazy Eddie electronics store chain, was extradited from Israel in 1993. Dan Hulshizer / AP Photo

Crazy Eddie enjoyed 18 years of business success in the 1970s and 1980s. However, this wasn’t purely down to its "insane prices."

Founder Eddie Antar regularly understated the company’s income to avoid taxes, then put some of the money he had been siphoning off back into the company after it went public in order to get a better price for the stock.

The company was bankrupt by the end of the 1980s, and Antar was sentenced to six years in prison for fraud.

24. Ivan Boesky

Financier Ivan Boesky in 1985. AP Photo

Country: United States

Company: Ivan F. Boesky & Company

Type of business: Stock brokerage

Fraud amount: $200 million

Bottom Line: Ivan Boesky

Ivan Boesky was convicted of illegal insider trading in 1987. AP Photo

Insider trading was illegal in the 1980s, but cases were rarely prosecuted. This made it easier for former American stock trader Ivan Boesky to act on inside information to speculate on corporate takeovers, which secured him more than $200 million in total.

Boesky was eventually charged with fraud, fined $100 million and sentenced to three-and-a-half years in jail in 1987. Gordon Gecko, the protagonist in the film “Wall Street” (played by Michael Douglas) was partly based on Boesky.

23. Charles Ponzi

Charles Ponzi was an Italian businessman and con artist in the U.S. and Canada. Wikimedia Commons

Country: United States

Company: Securities Exchange Company

Type of business: Investment

Fraud amount: $200 million

Bottom Line: Charles Ponzi

Charles Ponzi writing his life story. AP Photo

A "Ponzi scheme" scam gets its name from Charles Ponzi, who duped thousands of Americans in 1920 into believing that he was making fantastic returns by buying postal coupons at a discount, then sending them overseas to sell them for a large profit.

When government auditors discovered Ponzi was $7 million in the red, he was arrested and convicted on federal charges of using the mail to defraud, serving a three-and-a-half-year sentence.

He served a further jail term after being convicted on state charges to defraud.

22. Barry Minkow

Barry Minkow was convicted on 57 counts of swindling investors in connection with the ZZZZ Best carpet cleaning securities fraud case. AP Photo

Country: United States

Company: ZZZZ Best

Type of business: Carpet cleaning

Fraud amount: $200 million

Bottom Line: Barry Minkow

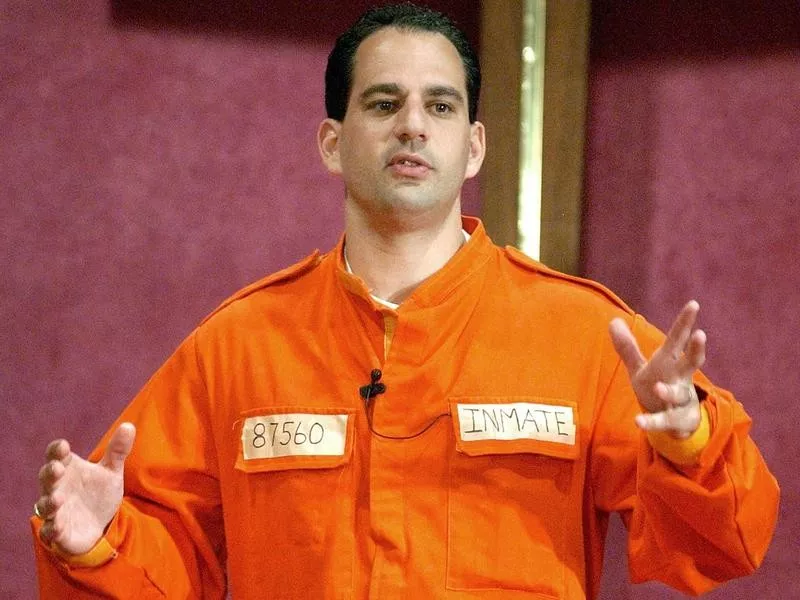

Barry Minkow wears a prison jumpsuit costume and delivers a sermon on materialism at the Community Bible Church in San Diego in 2002. Denis Poroy / AP Photo

In the 1980s, teenager Barry Minkow claimed his company ZZZZ Best would become the "General Motors of carpet cleaning." However, his rapidly growing business was based on forgery and theft.

Minkow falsified thousands of documents and sales receipts to trick auditors and investors. In 1986, he floated ZZZZ Best on the NASDAQ with a value of more than $200 million. His scam was uncovered the following year, and he was sentenced to 25 years in prison.

After prison, Minkow became a pastor and fraud investigator but later was convicted of more fraud, including cheating his San Diego church congregation out of over $3 million. He was sent back to prison, then released again, and ordered to pay $612 million in restitution.

21. Charles H. Keating

Charles H. Keating in 1955. GS / AP Photo

Country: United States

Company: American Continental Corporation

Type of business: Investment

Fraud amount: $250 million

Bottom Line: Charles H. Keating

Charles Keating became infamous for his role in the savings and loan scandal of the late 1980s. Sam Jones / AP Photo

Property investor Charles H. Keating scammed 23,000 investors out of $250 million by telling them their money was being invested in top quality assets. In actual fact, it was being put into high-risk ventures.

Keating reaped the rewards, throwing extravagant parties and traveling by private jet. He even gave $1 million to Mother Theresa.

His business failed in 1989, and he was convicted of fraud and served four-and-a-half years in jail.

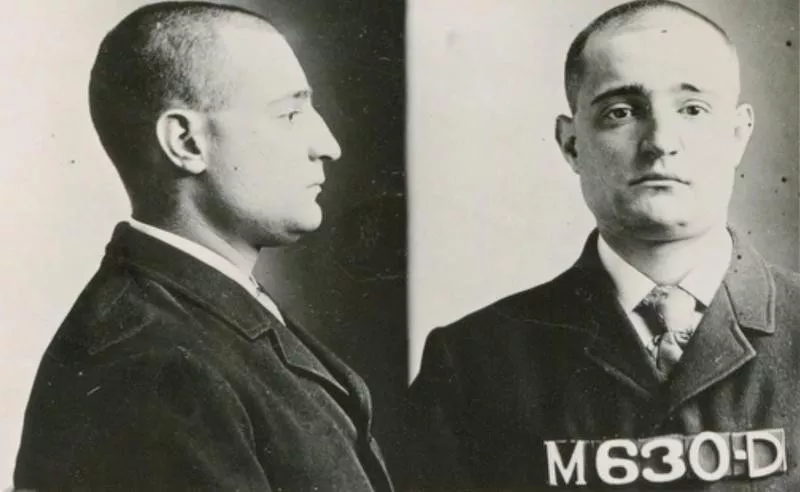

20. Philip Musica/Frank Coster

Philip Musica's criminal career spanned three decades. Robert Kalm / Vimeo

Country: United States

Company: McKesson and Robbins

Type of business: Pharmaceutical wholesale

Fraud amount: $285 million

Bottom Line: Philip Musica/Frank Coster

Philip Musica was also known as Frank Coster. Robert Kalm / Vimeo

Before McKesson Corporation was one of the biggest healthcare companies in the world, it was McKesson and Robbins, a front for Prohibition-era bootlegging.

The man behind the scam was professional swindler Philip Musica, who assumed the alias of Frank Coster (one of several he used during his criminal career) and enlisted the help of his brothers to inflate company assets by hundreds of millions of dollars (in today’s money).

They skimmed millions, which they pocketed thanks to numerous fictitious partner companies they had formed.

19. Sam Israel III

Samuel Israel III pleaded guilty to conspiracy and fraud charges. Julie Jacobson / AP Photo

Country: United States

Company: Bayou Hedge Fund Group

Type of business: Investment

Fraud amount: $300 million

Bottom Line: Sam Israel III

Samuel Israel III cost investors about $450 million. Adam Rountree / AP Photo

Sam Israel III conned wealthy investors out of $450 million through his Bayou Hedge Fund Group, which he founded in 1996. In order to provide good (fake) returns, he also set up a bogus accounting firm to carry out his audits.

When Israel was rumbled, he was convicted and sentenced to 20 years in jail. But he had one more scam: He faked his own suicide and went on the run.

He surrendered after only one month and got another two years added onto his original sentence.

18. Robert Maxwell

British newspaper magnate Robert Maxwell. AP Photo

Country: United Kingdom

Company: Mirror Group Holdings

Type of business: Media

Fraud amount: $400 million

Bottom Line: Robert Maxwell

A casket containing the body of Robert Maxwell in 1991. Santiago Lyon / AP Photo

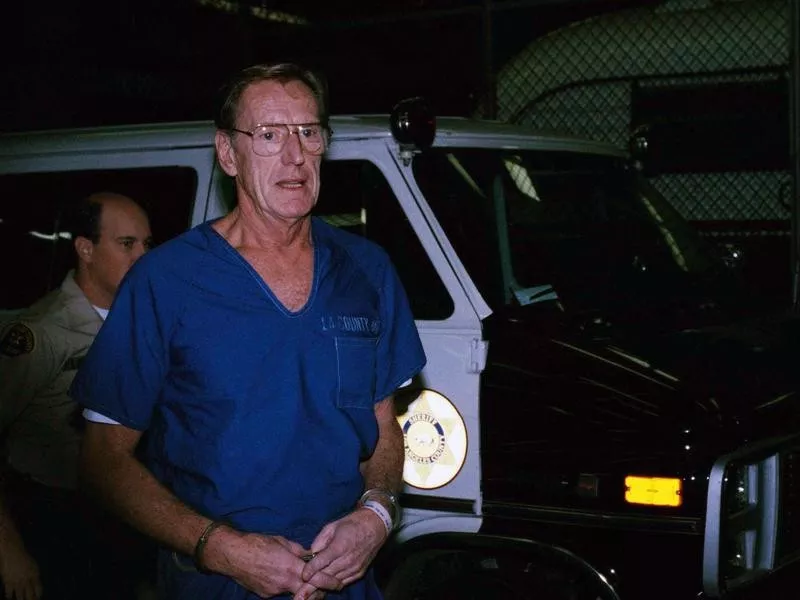

One fraudster who was never held accountable for his scams was Robert Maxwell, the owner of several U.K.-based media companies.

After Maxwell’s mysterious death in 1991 – he died at sea, either by jumping, falling or being pushed off his luxury yacht – authorities discovered that he had rescued his empire from bankruptcy by taking hundreds of millions of pounds from his companies’ pension funds.

17. Reed Slatkin

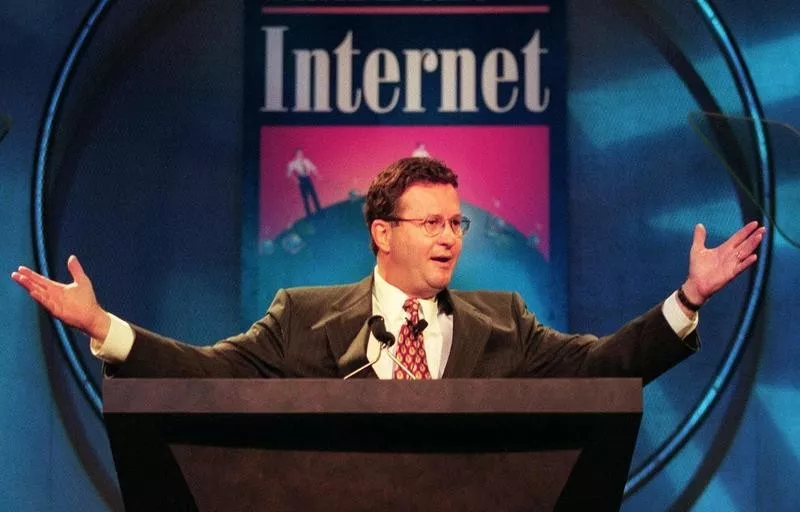

Investment manager and Earthlink cofounder Reed Slatkin pleaded guilty to orchestrating a massive financial scam. Nick Ut / AP Photo

Country: United States

Company: The Reed Slatkin Investment Club

Type of business: Investment

Fraud amount: $593 million

Bottom Line: Reed Slatkin

Reed Slatkin was responsible for at least $254 million in losses. CNBC via Wise Beard Man / YouTube

Reed Slatkin capitalized on his position as an ordained Scientology minister (who had trained with the movement’s founder L. Ron Hubbard) to set up an unlicensed investment club.

His Ponzi scheme tricked hundreds of rich investors, including big names like actor Giovanni Ribisi, who had no idea their cash was going into failed business ventures or artwork, cars and aeroplanes for Slatkin himself.

In 2002, he pleaded guilty to 15 counts of fraud and was sentenced to 14 years in prison.

16. Dennis Kozlowski and Mark Swartz

Tyco chairman and CEO Dennis Kozlowski, right, with Tyco CFO Mark Swartz, in 2002. Shawn Baldwin / AP Photo

Country: United States

Company: Tyco International

Type of business: Security systems

Fraud amount: $600 million

Bottom Line: Dennis Kozlowski and Mark Swartz

Dennis Kozlowski, center, was convicted of looting Tyco of more than $600 million in corporate bonuses and loans. Gregory Bull / AP Photo

Tyco International CEO Dennis Kozlowski and CFO Mark Swartz relied on stock fraud, unearned bonuses and forged expense accounts to take $600 million from the industrial products and services company.

Their massive racketeering scheme, which involved taking $170 million from the company itself and reaping another $430 million by covertly selling Tyco stock while artificially inflating the value of that stock, saw them convicted of multiple counts of fraud in 2005.

Kozlowski served six-and-a-half years in jail, while Swartz served eight years.

15. James Paul Lewis Jr.

James Paul Lewis leaves a federal courthouse in Houston in 2004. Pat Sullivan / AP Photo

Country: United States

Company: Financial Advisory Consultants

Type of business: Investment

Fraud amount: $814 million

Bottom Line: James Paul Lewis Jr.

James Paul Lewis, left, is taken to jail in 2004. Carlos Sanchez / AP Photo

James Paul Lewis Jr. managed to keep his nationwide Ponzi scheme going for 20 years.

He swindled thousands of investors who believed he made money by buying and selling distressed businesses, leasing equipment to medical offices and financing medical insurance premiums.

In 2004, Lewis J. was eventually arrested in a Houston motel. He later pleaded guilty to two felony counts of mail fraud and money laundering and was sentenced to 30 years in jail.

14. Elizabeth Holmes

Elizabeth Holmes arrives at the White House in 2015 for a state dinner. Andrew Harnik / AP Photo

Country: United States

Company: Theranos

Type of business: Health technology

Fraud amount: $945 million

Bottom Line: Elizabeth Holmes

Elizabeth Holmes, center, walks into federal court in San Jose, California, with her partner Billy Evans, right, and her parents for sentencing in 2022. Nic Coury / AP Photo

Elizabeth Holmes was supposed to be Silicon Valley's next big thing as the founder and CEO of health technology startup Theranos. Some people even compared her to Steve Jobs. But instead of changing the world and revolutionizing healthcare by simplifying blood testing, the "revolutionary" health technology at Theranos turned out to be one big scam.

After Holmes raised $945 million from investors, including more than $400 million from venture capital, Theranos was valued at $9 billion in 2014, and Forbes called the 30-year-old the "world's youngest self-made female billionaire." In 2015, Wall Street Journal investigative reporter John Carreyou exposed that Theranos did not have any special machines to detect health problems with a drop of blood.

Holmes made it all up. She was indicted in 2018 and convicted in early 2022 on four counts of defrauding investors of more than $140 million. In November 2022, she was sentenced to 11 years and three months in prison, ending her days living in the lap of luxury.

13. Praetorian Guard

The Praetorian Guard was an elite unit of the Roman army. JÄNNICK Jérémy / Wikimedia Commons

Country: Roman Empire

Company: N/A

Type of business: N/A

Fraud amount: Unknown

Bottom Line: Praetorian Guard

The Praetorian Guard served as personal bodyguards and intelligence for Roman emperors. Albert Krantz / Wikimedia Commons

In 193 A.D., a time of severe unrest in the Roman Empire, the Praetorian Guard did something diabolical. The special army was supposed to be loyal to the emperor, but instead, they assassinated the emperor, Pertinez, and sold the empire to the highest bidder.

That was wealthy senator Didius Julianus, who came up with a truly astronomical price: 25,000 sestertii for every member of the army (about $1 billion today).

But the plan didn’t work out as intended. The new "emperor" was never recognized and quickly deposed, and the real emperor, Severus, executed the guards who ran the scam.

12. Dean Buntrock

Dean Buntrock founded and led Waste Management. Horatio Alger Association / YouTube

Country: United States

Company: Waste Management

Type of business: Trash hauling/recycling

Fraud amount: $1.7 billion

Bottom Line: Dean Buntrock

Dean Buntrock overstated Waste Management's profits during a five-year period in the mid-1990s. Horatio Alger Association / YouTube

When a new management team took over Waste Management, the biggest trash hauler and recycler in the U.S. in 1998, they took a close look at the books.

It wasn’t good news. The new CEO discovered that the former managers, led by the founder Dean Buntrock, had recorded $1.7 billion in fake profits by falsifying the depreciation rate of its property, plant and equipment.

They cooked the books to hit earnings targets and get bonuses. Shareholders subsequently sued the company for fraud, winning a class-action lawsuit for $457 million.

11. Stanley Goldblum

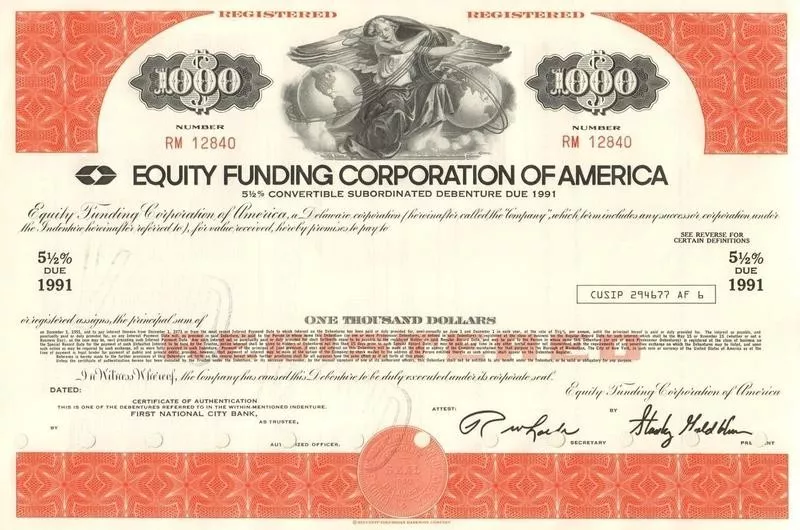

Stanley Goldblum was sentenced to eight years in prison and served four. Granite Media

Country: United States

Company: Equity Funding Corporation of America

Type of business: Life insurance

Fraud amount: $2 billion plus

Bottom Line: Stanley Goldblum

Stanley Goldblum's insurance fraud cost investors $300 million and reinsurance companies $1.8 billion. OldStocks.com

The Equity Funding Corporation of America (EFCA) sold life insurance in the early 1960s, but a huge number of their policies were fake.

EFCA sold them to reinsurance companies for a profit, sold other fake policies to cover the premiums on the original policies and even faked the deaths of policyholders to cash in the benefits.

EFCA president and chairman Stanley Goldblum pleaded guilty to five counts of conspiracy and fraud and subsequently served four years of an eight-year sentence.

10. Richard Scrushy

HealthSouth founder Richard Scrushy at the company's headquarters in Birmingham, Alabama, in 1997. Dave Martin / AP Photo

Country: United States

Company: HealthSouth Corporation

Type of business: Healthcare services

Fraud amount: $2.8 billion

Bottom Line: Richard Scrushy

Richard Scrushy with his wife, Leslie, take a break during his fraud trial in 2005. Butch Dill / AP Photo

From 1996 through 2002, HealthSouth CEO Richard M. Scrushy and several CFOs and executives took part in an accounting scandal to the tune of $2.8 billion.

Scrushy was the ringleader, ordering company employees to falsely report grossly exaggerated company earnings in order to meet stakeholder expectations. After one of the company’s cofounders, Aaron Beam, blew the whistle, Scrushy was charged on several charges of fraud.

He was acquitted, but later went to jail on a charge of bribing the governor of Alabama and served a five-year sentence.

9. Joseph Nacchio

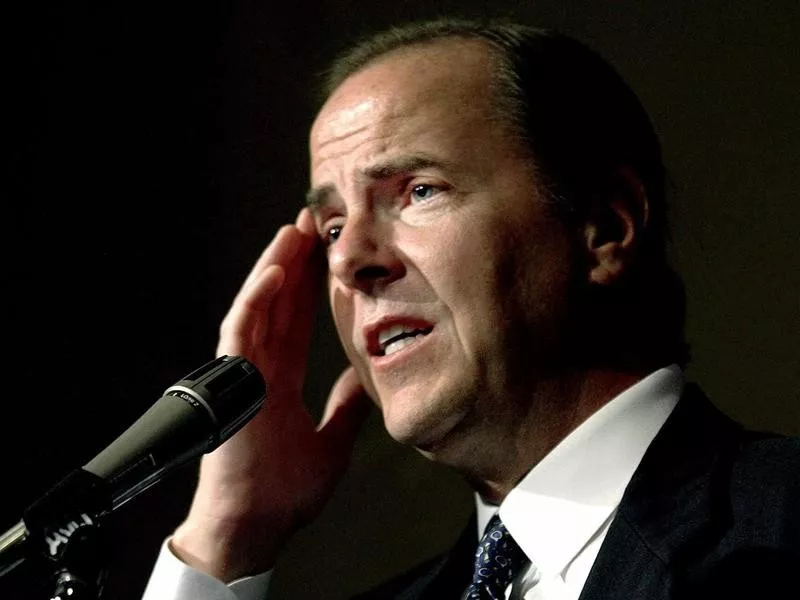

Joseph Nacchio was the chairman and CEO of Qwest Communications. Diane Bondareff / AP Photo

Country: United States

Company: Qwest Communications

Type of business: Telecommunications

Fraud amount: $3 billion

Bottom Line: Joseph Nacchio

Joe Nacchio, center, was found guilty of insider trading in 2007. Jack Dempsey / AP Photo

In 2000, Qwest Communications’ stock traded as high as $64 per share thanks to accounting fraud over several years.

After the scam was exposed by a whistleblower, stock plummeted to less than $1 in 2002. At a 2007 trial, former Qwest CEO Joseph Nacchio was found to have illegally sold stock when he knew the company faced financial challenges.

He was convicted of 19 of 42 insider trading charges and served a four-and-a-half-year jail sentence.

8. Bernard Ebbers

WorldCom president and CEO Bernard Ebbers, right, in 1997. Todd Plitt / AP Photo

Country: United States

Company: WorldCom

Type of business: Telecommunications

Fraud amount: $3.8 billion

Bottom Line: Bernard Ebbers

Former WorldCom CEO Bernard Ebbers on Capitol Hill in 2002 during a hearing before the House Financial Services Committee. Ebbers invoked his Fifth Amendment rights and did not testify before the committee. Dennis Cook / AP Photo

WorldCom once had $103.9 billion in assets on its books, but it was completely wiped out by its 2002 bankruptcy — the result of a huge accounting fraud led by former CEO Bernard Ebbers.

Operating expenses were recorded as investments, with around $3.8 billion of expenses classified as assets. The subsequent $6.1 billion securities class-action lawsuit is one of the largest of all time.

In 2006, Ebbers was sentenced to 25 years in jail. He got early release in December 2019, at age 78, and died just over a month later.

7. David Walsh

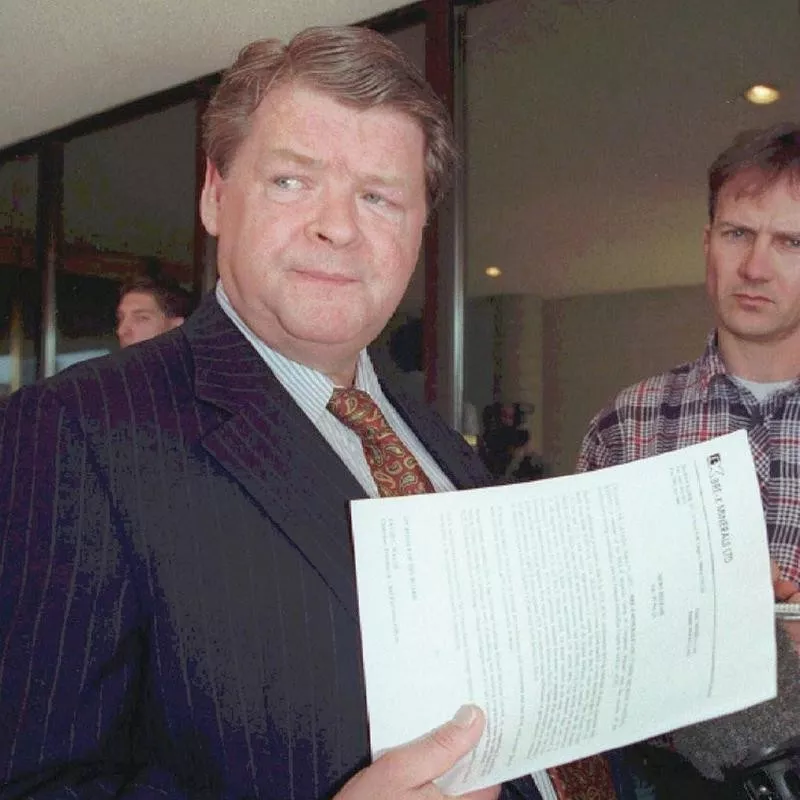

Bre-X Minerals president David Walsh during a news conference in 1997. Jim Wells / AP Photo

Country: Canada

Company: Bre-X Minerals

Type of business: Mining

Fraud amount: $6 billion

Bottom Line: David Walsh

The Bre-X Minerals complex in Borneo did not have any gold worth mining. Gatra Magazine ATRA MAGAZINE / AP Photo

Bre-X Minerals, founded by David Walsh, claimed to own the richest gold mine in history. Its Indonesian property reportedly housed more than 200 million ounces, and at its peak, the company had a market capitalization of $6 billion.

But in 1997, the gold mine was exposed as a fraud, and its stock plummeted. It left numerous investors out of pocket to the tune of millions, including the Ontario Teachers’ Pension Plan, which lost $100 million.

6. Allen Stanford

Allen Stanford, second from left, in 2008. Lefteris Pitarakis / AP Photo

Country: United States

Company: Stanford Financial Group

Type of business: Investment

Fraud amount: $8 billion

Bottom Line: Allen Stanford

Allen Stanford bilked investors out of $8 billion as part of a massive Ponzi scheme. Pat Sullivan / AP Photo

Allen Stanford’s investment fund defrauded thousands to the tune of $8 billion.

Authorities started investigating the high returns his fund apparently made for its customers, after the Securities and Exchange Commission filed a civil complaint, accusing Stanford and his associates of running a "massive, ongoing fraud."

Three years later, Stanford was found guilty of operating a Ponzi scheme and jailed for 110 years.

5. Daniel Mudd, Enrico Dallavecchia, and Thomas Lund

Former Fannie Mae president and CEO Daniel Mudd in 2007. Manuel Balce Ceneta / AP Photo

Country: United States

Company: Fannie Mae

Type of business: Mortgages

Fraud amount: $11 billion

Bottom Line: Daniel Mudd, Enrico Dallavecchia, and Thomas Lund

The SEC settled its fraud case against Daniel Mudd. Larry Neumeister / AP Photo

It was one of the largest civil penalties ever imposed in an accounting fraud case. Mortgage giant Fannie Mae was ordered to pay $400 million to settle charges of manipulating financial statements from 1998 through 2004.

The U.S. government assumed control of Fannie Mae in 2008, and three years later, three of its former top executives were charged with securities fraud.

They all settled out of court, escaping incarceration.

4. Walter Forbes

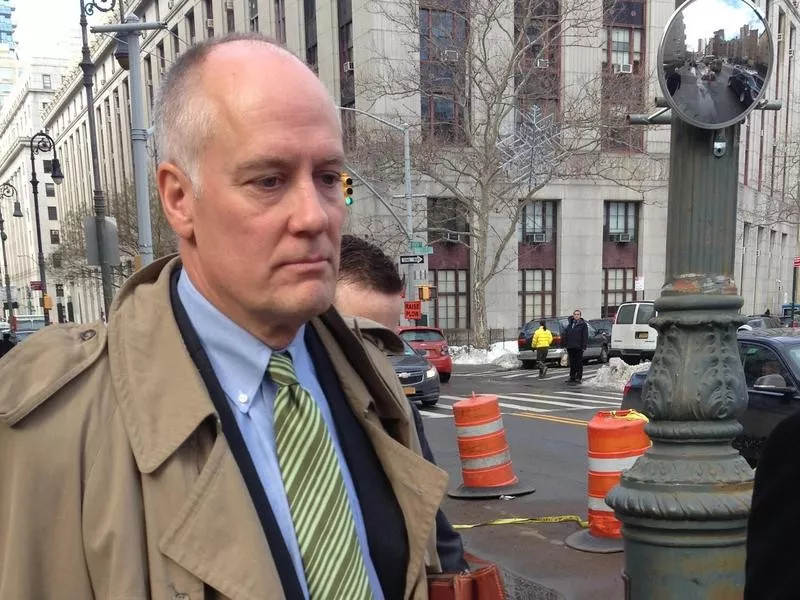

Former Cendant chairman Walter Forbes arrives for a sentencing hearing in 2007. Michelle McLoughlin / AP Photo

Country: United States

Company: Cendant Corporation

Type of business: Hospitality and real estate

Fraud amount: $19 billion

Bottom Line: Walter Forbes

Walter Forbes was sentenced to serve 151 months in jail and pay $3.75 billion in restitution for accounting fraud. Michelle McLoughlin / AP Photo

Cendant CEO Walter Forbes was the mastermind behind a 1998 accounting fraud that led to investors losing $19 billion.

In 2006, Forbes was found guilty of conspiracy and two counts of submitting false reports to the U.S. Securities and Exchange Commission in overstating his company’s earnings by over $250 million.

He was sentenced to 12 years, seven months in prison and ordered to pay $3.275 billion in restitution.

3. Bernie Madoff

Disgraced financier Bernie Madoff leaves court in Manhattan in 2009. Kathy Willens / AP Photo

Country: United States

Company: Bernard L. Madoff Investment Securities

Type of business: Investment

Fraud amount: $65 billion

Bottom Line: Bernie Madoff

Bernie Madoff swindled investors out of billions. Kathy Willens / AP Photo

New York money manager Bernie Madoff‘s $65 billion Ponzi scheme is the largest fraud ever by an individual.

Madoff, who turned 82 in 2020, was sentenced to 150 years in jail.

Madoff’s sons Mark and Andrew never faced criminal charges, but in 2017, $23 million from their estates went to victims of their father’s scam.

2. Jeffrey Skilling

Enron CEO and president Jeffrey Skilling in 2001. LM Otero / AP Photo

County: United States

Company: Enron Corporation

Type of business: Energy, commodities and services

Fraud amount: $78 billion

Bottom Line: Jeffrey Skilling

Jeffrey Skilling, center, testifies before a Senate Commerce Committee hearing on Enron in 2002. Ron Edmonds / AP Photo

Massive accounting fraud enabled by then-CEO Jeffrey Skilling wiped out $78 billion in Enron’s stock market value. Skilling employed various tactics to let the company move hundreds of millions of debts off its books, such as booking fake revenues to grossly inflate earnings.

In 2006, Skilling was convicted of 19 counts of conspiracy, securities fraud, insider trading and lying to auditors, and was jailed until 2019.

A $7.2 billion securities class-action lawsuit with various banks and other defendants over Enron’s collapse remains the largest of all time.

1. Dick Fuld and Erin Callan

Lehman Brothers Holdings chairman and CEO Dick Fuld in 2007. Kevin Wolf / AP Photo

Country: United States

Company: Lehman Brothers

Type of business: Investment

Fraud amount: $300 billion

Bottom Line: Dick Fuld and Erin Callan

Dick Fuld, front center, is heckled by protesters on Capitol Hill in 2008 after testifying on the collapse of Lehman Brothers. Susan Walsh / AP Photo

No criminal charges were brought against Dick Fuld and Erin Callan, the top executives of investment bank Lehman Brothers, which had the largest bankruptcy in history and contributed to the global financial crisis.

But during investigations, a bankruptcy examiner’s report said there were "colorable" claims against both the executives and the company’s auditor, Ernst and Young, for fraud.

Lehman Brothers had $639 billion in assets and $619 billion of debt when it filed for bankruptcy in late 2008.