What people consider a basic expense looks very different today than it did a generation ago. Millennials are budgeting for things that simply did not exist, or did not matter, when Boomers were coming of age. It is not just about higher prices. The economy, technology, and daily expectations have all undergone significant changes. These are ten purchases that now feel routine, but were never part of the Boomer checklist.

Streaming Subscriptions Instead Of Cable Boxes

Credit: Canva

Cable came with a remote and a channel lineup. Now, it’s a rotating cast of streaming apps. Most Millennials juggle at least three subscriptions at once, according to Forbes. The reruns still exist, but they coexist with algorithm-recommended originals, along with monthly charges that appear like clockwork.

Renting Clothes Like They’re Movies

Credit: Wikimedia Commons

Instead of owning a closet full of one-time outfits, Millennials are borrowing their wardrobe. Platforms like Nuuly and Rent the Runway treat fashion like a streaming service: wear it, return it, repeat. It’s especially popular for events and seasonal swaps. Rental fashion also taps into the "less stuff, more style" mindset.

Food Delivery That Skips the Phone Call

Credit: Wikimedia Commons

Ordering takeout used to mean dialing the restaurant and hoping they heard your address right. Millennials open an app, scroll through dozens of choices, and track the delivery car in real-time. DoorDash and Uber Eats have made this standard practice. Pew Research shows food delivery use spiked among young adults.

Plastic Surgery Before 30

Credit: Getty Images

According to the American Academy of Facial Plastic and Reconstructive Surgery, more than 70 percent of facial plastic surgeons report an increase in patients under 30 seeking injectables. Constant exposure to front-facing cameras and curated social feeds plays a role. Even without filters, many people want their real appearance to align with the version of themselves they see online every day.

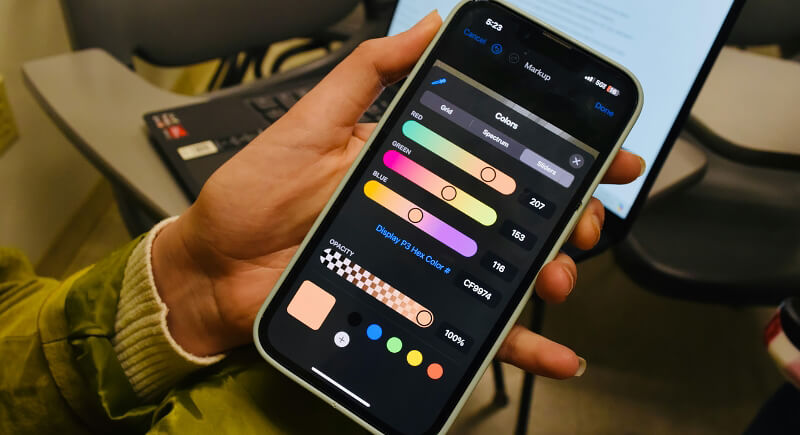

Monthly Payments for Digital Tools

Credit: pexels

Instead of buying software once and using it for years, Millennials now subscribe to entire ecosystems. Cloud storage, editing tools, language apps, and résumé platforms all come with monthly fees. Some even pay for services that track and cancel other subscriptions on their behalf. It is a generation paying to manage the very apps it relies on.

Therapy as Preventive Care

Credit: Getty Images

Therapy used to carry a stigma. For Millennials, it's often just part of staying balanced. A 2023 Pew survey showed more than half of adults under 40 had received mental health services. Online platforms like BetterHelp and Talkspace made access easier, and cultural shifts have made it far more accepted.

Grocery Delivery with a Side of Fees

Credit: Canva

Millennials often outsource shopping and pay extra for the convenience. Whether it’s Instacart or a store-specific app, the fees can include service charges and product markups. According to Statista, grocery delivery has become a weekly expense for nearly a third of young households. It saves time, but it doesn’t come cheap.

Houseplants as Decor and Self-Care

Credit: pexels

Succulents and monsteras are no longer an afterthought on a windowsill. They sit front and center in Millennial homes, shaping how a space feels and how people unwind in it. Caring for plants doubles as a calming routine, while social media has turned it into a shared hobby. Swapping cuttings, chasing rare varieties, and watching propagation videos are now part of the appeal.

Freezing Eggs to Delay Parenting

Credit: Canva

Boomers rarely talked about fertility planning unless it was in a doctor’s office. Millennials with later timelines are preserving options through egg freezing. A single cycle can cost over $10,000, plus annual storage fees. Companies like Facebook and Apple even include it as an employee benefit.

Smartphones That Cost More Than Laptops

Credit: Canva

The flip phone didn’t come with facial recognition or monthly payments longer than a car lease. Consumer Reports states that the average American pays over $100 per month for mobile service alone. For Millennials, the phone is also their GPS, bank, office, and ticket to everything.