The Trump Administration is back in 2025 with fresh ideas—and some of them are already changing how Social Security works. Benefits, eligibility, taxes, and even timelines are seeing tweaks that could impact millions. Before the fine print catches you off guard, this article breaks down the biggest changes that are worth knowing.

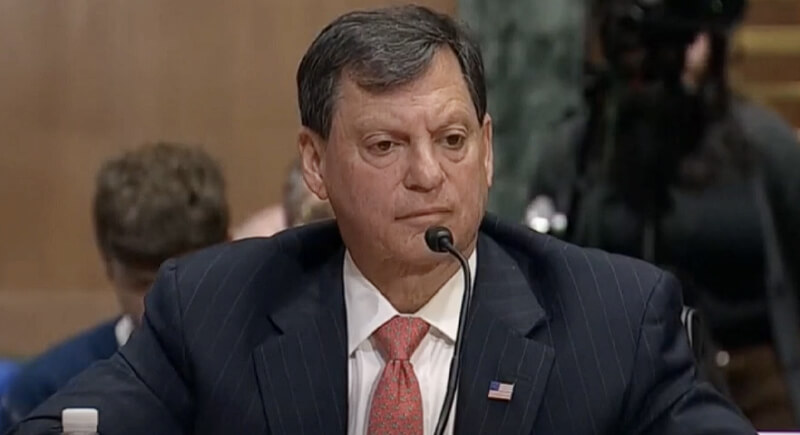

Leadership Appointment

Credit: Youtube

Frank Bisignano, CEO of fintech giant Fiserv and a longtime Trump ally, has been tapped to lead the Social Security Administration. According to his confirmation hearing, his focus is on efficiency without trimming benefits. This is a positive note on modern tech upgrades, but others worry about corporate influence creeping into public services.

Department of Government Efficiency (DOGE) Oversight

Credit: Wikimedia Commons

The Department of Government Efficiency (DOGE), spearheaded by Elon Musk, has been making waves with its bold moves to streamline federal operations. One of its most debated plans is gaining access to the SSA's data. Musk's team claimed they were on a mission to eliminate fraud, but not everyone agreed to the idea.

Debt Collection

Credit: Getty Images

Under the 2025 Trump Administration, efforts to recover overpaid benefits are getting more aggressive, with new tools and faster timelines. That means if the SSA thinks you were overpaid, they can start clawing back money quicker than before. Critics argue it could hit vulnerable retirees the hardest, especially those unaware they owe anything.

Staff Reductions

Credit: flickr

The Social Security Administration is trimming its team big time. Under Trump's 2025 plan to downsize the federal workforce, around 7,000 positions are on the chopping block. They may do it for budget efficiency, but fewer employees also mean longer waits, slower claims, and overwhelmed phone lines.

Office Closures

Credit: flickr

Getting help with Social Security could mean driving a lot farther—or not getting in at all. The Trump Administration's 2025 budget plan includes closing dozens of SSA field offices, especially in rural and lower-traffic areas. With fewer doors open, even simple benefit updates could turn into a cross-country road trip or a long, frustrating wait on hold.

Elimination of Phone Applications

Credit: Getty Images

If you're used to picking up the phone to apply for Social Security benefits, that option’s out. A new rule is pushing everyone to either go online or show up in person—great if you’re tech-savvy or live near an SSA office, but not so great if you’re not.

In-Person Identity Verification

Credit: Canva

Starting March 31, 2025, you can’t verify your identity with the SSA over the phone anymore. If your account gets flagged or they need to confirm who you are, it’s either online with extra security steps or an in-person visit. It might boost security, but it is a real hassle for anyone without good internet or a nearby office.

Increased Online Services

Credit: Prostock-studio

More services like benefit estimates, appeals, and status updates have shifted online. The SSA says the goal is convenience and faster processing, but many feel left behind. It's a big change for a system that millions rely on, and if you're not already tech-savvy, now's the time to brush up—or risk getting stuck in digital limbo.

Increased Transparency Initiatives

Credit: iStockphoto

The SSA has launched new transparency efforts. Their website now shares more stats, clearer performance metrics, and regular updates. It gives the public a closer look at how the agency is handling claims, wait times, and appeals. For once, you don't need a law degree to understand what's going on behind the scenes.

Increased Customer Service Wait Times

Credit: pixelshot

Customer service wait times have ballooned as thousands of staff have been cut and more services moved online. Some callers report holding for over an hour—just to get transferred again. The SSA's shift toward automation and digital tools hasn't precisely smoothed things out for those who prefer a human voice.

Potential Tax Exemptions

Credit: Pix4free

There's a buzz about lifting taxes on Social Security benefits, and it's gaining traction under Trump's 2025 agenda. The idea is to stop taxing retirement benefits for recipients. Supporters say it's long overdue—why tax money that was already taxed before? However, critics argue it could speed up the program's depletion timeline.

The Average Monthly Payment

Credit: freepik

The cost-of-living adjustment for 2025 is 2.5%, which is noticeably smaller than the 3.2% bump in 2024. Checks still grew, but not as much—especially while prices for basics like food and utilities kept creeping up. Sure, it's better than nothing, but many feel it barely keeps pace with inflation.

The Maximum Social Security Benefit

Credit: Getty Images

If you're aiming for the Social Security jackpot, here's the number to beat: $5,108. That's the maximum monthly retirement benefit in 2025. Even if most people don't hit that ceiling, it's still a reminder that delaying benefits and maximizing your earnings over time can pay off in the long run.

Policy Changes Affecting Rural Communities

Credit: Wikimedia Commons

Living in a small town has its perks—until you must deal with Social Security. In 2025, rural communities are feeling the pinch thanks to policy shifts under the Trump Administration. Office closures, staff cuts, and the push for online-only services hit especially hard where broadband is spotty and public transit is basically nonexistent.

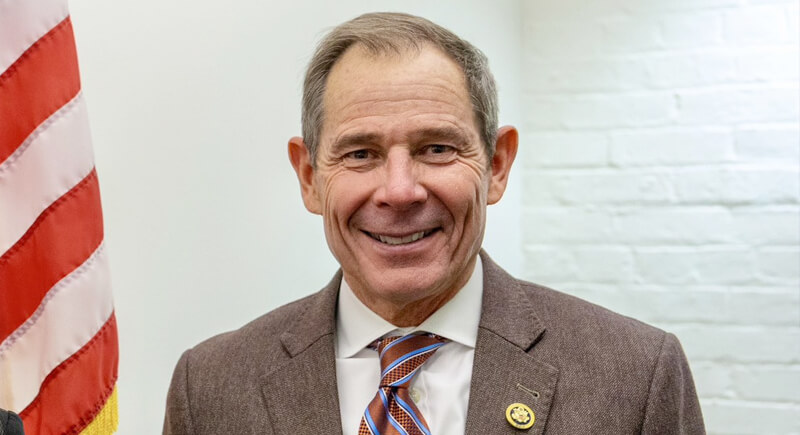

Legislative Proposals for Reform

Credit: X

Social Security reform is back in the spotlight, with lawmakers tossing around big ideas in 2025. Republican Senator John Curtis introduced an idea to raise the full retirement age for younger generations. The proposal hasn't passed yet, but it's sparked a fresh round of debates in Congress.