Retirement is supposed to be the golden era with more freedom and less stress. You’re finally enjoying the life you worked so hard to build. But for many retirees, a few costly decisions turn that dream into a financial headache. Some purchases seem like great ideas at first, only to become ongoing burdens that drain savings and deliver little long-term value.

Smart financial decisions keep retirement funds working for you, not against you. Here are a few common splurges that many retirees later regret—and how to avoid them.

The Dream Home That Becomes a Financial Drain

Credit: freepik

Larger homes come with more than just extra space—they come with rising property taxes, ongoing upkeep, and climbing utility costs that never let up. Older roofs, HVAC systems, plumbing—everything needs attention eventually, and repairs rarely come cheap. Eventually, the house meant to be a comfort can become a financial strain. Many retirees find that downsizing not only reduces costs but frees up money for meaningful travel, experiences, and peace of mind.

Luxury Cars That Lose Value Fast

Credit: freepik

There’s no denying the appeal of a luxury car—the smooth ride, the polished design, the status that comes with the emblem on the grille. But the numbers tell a different story. A brand-new car can lose 20% to 30% of its value in the first year alone, and luxury models often depreciate even faster. Add in higher insurance premiums, premium fuel requirements, and pricier maintenance, and the cost of ownership grows quickly.

Vacation Homes That Sit Empty

Credit: freepik

A secondary vacation home sounds all fun and fabulous until you have to deal with property taxes, maintenance, and insurance after you’ve retired. The cost of your dream location can pile up quickly. Eventually, the costs outweigh the benefits, and renting a vacation home starts to seem like a more viable option.

High-End RVs That Rarely Leave the Driveway

Credit: pexels

Many people invest in an RV, considering it a ticket to adventure. Not only are these expensive, costing over $100,000, but they also add thousands more each year for gas, maintenance, and insurance. To make matters worse, these RVs are found more frequently in parking lots than on trips around the world. Retirees who really want to enjoy an RV experience should consider renting it for occasional trips to save money and hassle.

Risky Investments That Wipe Out Savings

Credit: freepik

Cryptocurrency, penny stocks, speculative tech plays—these are the kinds of investments that draw attention for their sky-high returns. In retirement, though, the risk-reward equation changes dramatically. Without a regular income to fall back on, losses are more challenging to recover from. Many retirees discover too late that chasing high returns often leads to steep losses. Financial advisors tend to recommend shifting toward more stable, income-generating options like dividend-paying stocks, municipal bonds, or laddered CDs. The goal isn’t excitement—it’s preservation and reliability.

Expensive Hobbies That Lose Their Appeal

Credit: pixabay

Certain hobbies come with hefty price tags—take, for example, golf club memberships, sailing, and luxury fitness programs. They can feel like a reward for years of hard work, but interest often fades faster than expected. Boats, for instance, aren’t just about buying the vessel. There’s storage, insurance, maintenance, and fuel. Golf clubs may charge initiation fees and annual dues, even if you stop playing. Before committing, it’s worth renting, borrowing, or testing the waters to see if the lifestyle actually suits your day-to-day routine.

Complete Home Renovations That Overpromise

Credit: freepik

Upgrading your kitchen or bathroom often costs more than anticipated and rarely recoups their full value. Instead of going for a complete overhaul, smaller updates—like energy-efficient appliances or accessible fixtures—can make your home more livable without overstretching your budget.

Fancy Kitchen Gadgets That Go Unused

Credit: freepik

It’s easy to get swept up in the latest gadgets—air fryers, espresso machines, sous-vide cookers. While some people love them, others find that the novelty wears off quickly. These appliances can cost hundreds or even thousands of dollars and take up valuable counter or storage space. Consider whether it fills a real need or just sounds fun. A sharp knife and a solid set of pans go a long way.

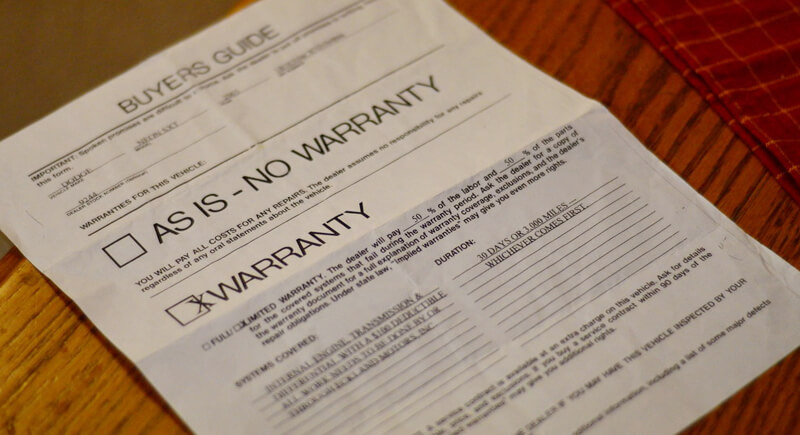

Extended Warranties That Rarely Pay Off

Credit: flickr

Although retailers pitch extended warranties as a safety net, especially for big-ticket items like TVs or cars, the reality is that most products don’t fail during the extended period, and many already come with solid manufacturer coverage. Credit cards often include built-in protection, too. Consumer advocacy groups frequently warn that these warranties are rarely worth the added cost. A better strategy is to build a small repair fund, which gives you flexibility without locking you into a contract filled with fine print.

Private Club Memberships That Go Unused

Credit: flickr

Once the initial novelty of a private club membership wears off, usage often drops—especially if travel, health, or shifting interests get in the way. Monthly fees can quietly add up to thousands per year. Unless you're attending regularly and getting value from the perks, it's worth reconsidering whether the cost aligns with your actual lifestyle.

Boats That Become More Work Than Fun

Credit: freepik

There’s a common saying in the boating world: the two happiest days in a boat owner’s life are the day they buy it and the day they sell it. Boats demand year-round attention—cleaning, winterizing, repairs, slip rental, and more. For many retirees, it turns from a leisure activity into a logistical headache. Unless you’re passionate about being on the water and willing to take on the maintenance, renting or joining a boat-sharing program is often a far more practical choice.

Expensive Travel Packages

Credit: freepik

Cruises, guided tours, and high-end resorts promise stress-free experiences. The only downside is that once you're locked into the package, you may find the pace too rushed, the excursions too rigid, or the hidden costs more than expected—gratuities, upgrades, port fees, and more. Independent travel, while requiring more planning, can offer more flexibility and a better return on your travel dollar. Look for destinations where your money goes further and where you can set your own pace.

Home Gym Equipment That Collects Dust

Credit: freepik

There’s a lot more that goes into fitness than buying equipment. Without consistent use, these machines often end up tucked into a corner, unused and taking up space. Studies show that adherence to home fitness routines drops sharply after the first few months. A more sustainable option might be joining a community fitness class, walking groups, or using public recreation centers. They're lower cost, social, and require less commitment upfront.

Fancy Funeral Pre-Payments That Limit Choices

Credit: pixabay

Prepaid funeral packages often come with rigid terms and inflated pricing. Some lock you into specific funeral homes or services and limit choices that your family might want to make later. In some states, prepaid funds aren’t fully protected if the provider goes out of business. A better approach might be setting aside funds in a payable-on-death savings account or using a modest life insurance policy earmarked for funeral costs.

Supporting Adult Children at Your Own Expense

Credit: Getty Images

Helping adult children can feel loving, but covering their rent, loans, or daily bills quietly erodes retirement security. What starts as temporary support often stretches for years. Many retirees later realize that their generosity delayed their travel, reduced their savings, and added stress they never planned for, with long-term consequences.

Timeshares

Credit: Getty Images

Timeshares promise affordable vacations forever, yet reality rarely matches the pitch. Annual maintenance fees rise, booking stays are difficult, and resale options are limited. Many retirees discover that they feel locked into yearly costs, even during years when travel slows or health changes unexpectedly later in retirement.